Mergers and acquisitions 20-YEAR ROLLERCOASTER RIDE

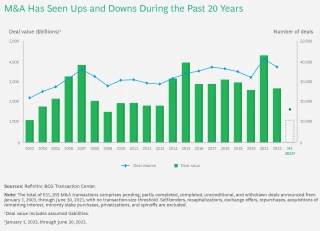

Over the past two decades of mergers and acquisitions, deal makers have experienced a roller coaster of highs and lows. (See the exhibit.) In 2003, they were recovering from the aftereffects of meteoric rise and sudden crash of the dot-com boom. Yet, their animal spirits were resilient. In less than five years, global deal values skyrocketed to record levels that were not again exceeded until eight years later. Propelling the surge was an uptick in private equity deal activity and innovative debt financing instruments that increased leverage.

Today, the trajectory of the market seems positive after bottoming out. Competing forces are at play, with challenges in financing counterbalanced by strong drivers, such as record cash reserves on corporate investors’ balance sheets.

To mark the 20th anniversary of our M&A Report, we looked back at our rich history of analyses related to deal value creation. We refreshed these insights using our proprietary data set of more than 900,000 deals spanning three decades. Our goal was to discern the success factors that distinguish top-tier deal makers from the rest of the pack. Among the many pivotal factors that we encountered, ten imperatives stood out as consistently crucial for mergers and acquisition success. These success factors have withstood the test of time, remaining as significant in our updated analyses as when we first identified them.

1. Be prepared and systematic

M&A can feel like the least plannable of business activities, as potential deals often arise spontaneously and opportunistically. And when the right target finally comes into the crosshairs, it is easy to succumb to deal fever. But as in all other significant investment situations, it pays to be well-prepared—even though, as the saying goes, “no plan survives first contact with the enemy.” Having the right team, tools, and established processes in place comes in very handy when the reality of a deal suddenly emerges.

Buyers need a detailed M&A strategy linked to the company’s strategic direction, carefully thought-out target search criteria, clear financial guardrails for evaluating deals, and playbooks for due diligence and especially post-merger integration. In our many surveys and analyses, we have found that acquisitions fail far more often because of a misguided M&A strategy or an inappropriate approach to integration rather than because of excessively high purchase prices or inadequate due diligence.

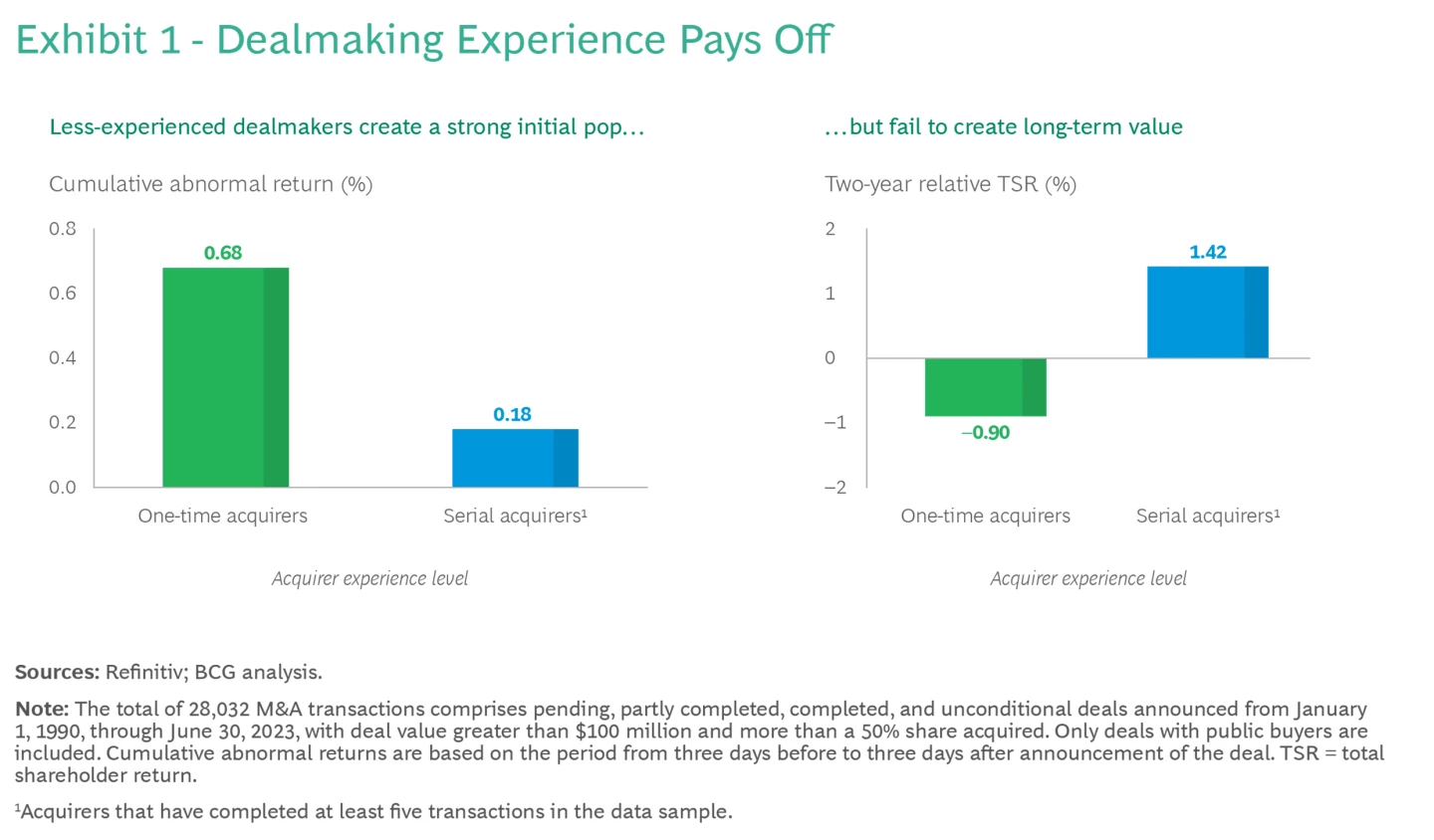

2. Build experience

Experience matters in M&A. Experienced acquirers can ramp up more quickly in time-critical M&A situations, are more precise in their due diligence, and know where the integration pitfalls lie. Experienced sellers know when to go to market, can prepare their assets properly, and negotiate more shrewdly. They also know when to walk away from a deal that is not meeting their objectives.

3. Master the art of timing

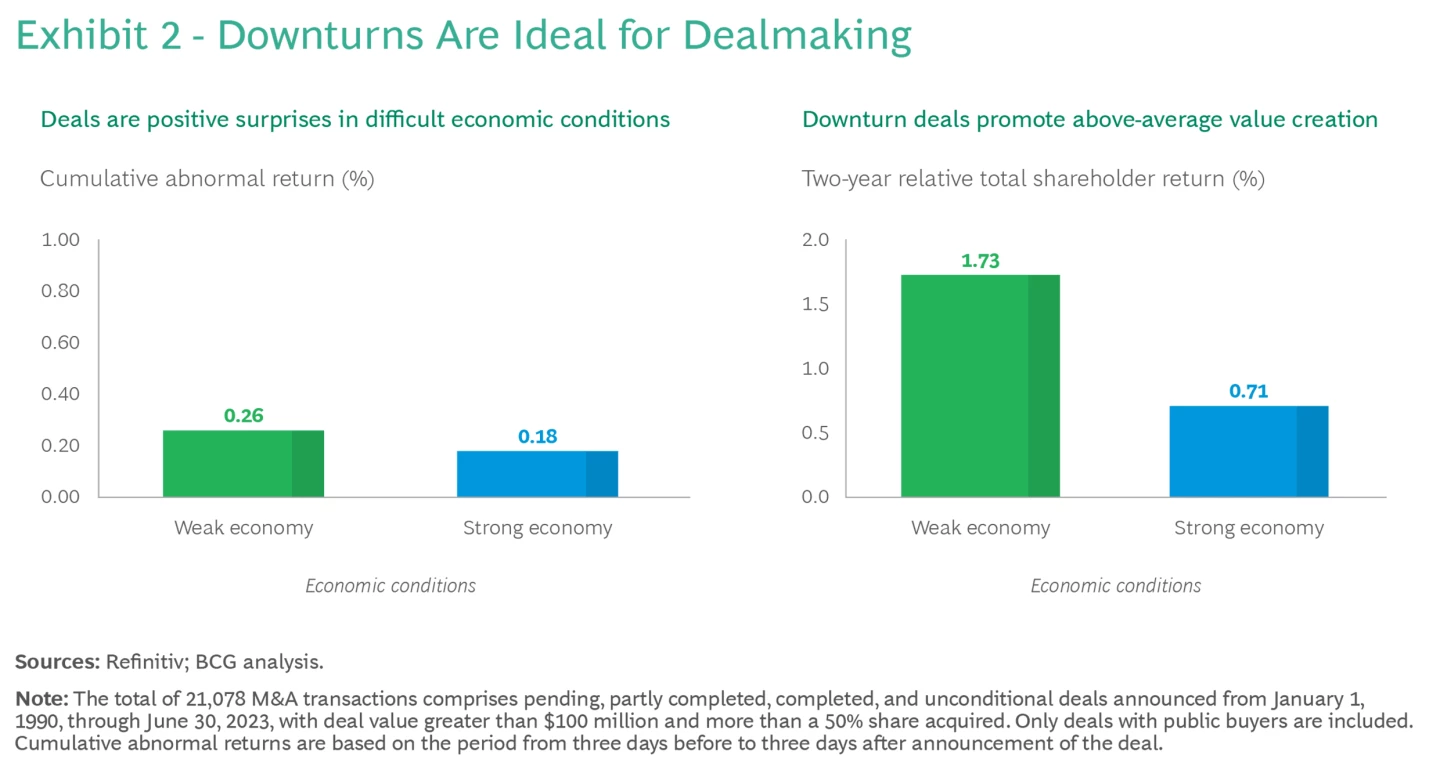

In M&A, as in many other areas of business, timing is half the battle. Arriving late, whether in the broader M&A or business cycle or in a specific deal situation, typically results in diminished post-deal value creation or a missed opportunity altogether.

4. Go outside your comfort zone, but not too far

Ever since conglomerates went out of fashion, the consensus in the Western business world has been that the best approach is to focus on the core business—not least from a shareholder perspective. In the M&A context, however, the situation is more nuanced. Our research shows that deals involving a company’s core products or regions do not create the most value. Rather, transactions in which deal makers go outside their comfort zone yield higher returns over the long term.

This may sound counterintuitive, but a closer look clarifies the picture. Yes, go beyond your comfort zone, but do not stray too far: cross-border deals, for example, are most successful if they remain in a company’s core region. This is understandable, given the challenges posed by unfamiliar regions and cultures. Similarly, deals focused on adjacent products and services that lie relatively close to a company’s core offerings yield more value than those that aim for broad diversification. At the other extreme, although pure roll ups and scale expansions can be beneficial, they are unlikely to drive long-term out performance. The keys to staying ahead of the pack are innovation and a degree of continuous reinvention. Rigorously sticking to one’s core may be effective for a while, but eventually a broader strategy will be necessary.

5. Focus on synergies—they justify the deal

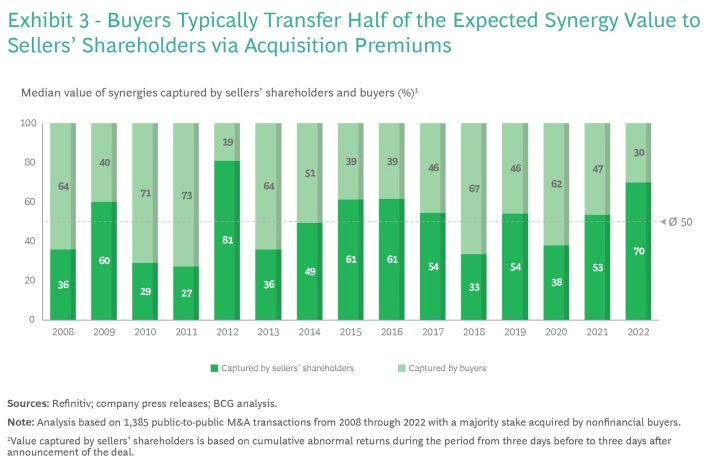

The importance of emphasizing synergies might seem obvious, since synergies are at the core of value creation in corporate M&A. By making acquisitions feasible when a target is not sufficiently attractive by itself, synergies allow corporate buyers to edge out financial sponsors in tight bidding situations.

Merely identifying potential synergies is a far cry from realizing them, however, and their value diminishes if the buyer simply passes them on to the seller via a higher purchase price. Our research reveals that, over the past 15 years, buyers in public M&A deals have retained only about 50% of synergies; the rest tends to be factored into the purchase price, although this rate fluctuates with market conditions. (See Exhibit 3.) Our studies repeatedly indicate that insufficient or unrealized synergies are among the main reasons why some deals are deemed failures.

Once the deal is inked, the focus should swiftly move to capturing the synergies, and here, typically, time is of the essence. Buyers should enlist the support of a clean team composed of third-party personnel no later than between signing and closing. This team can facilitate the exchange of highly sensitive data that is critical for refining synergy estimates.

Finally, communication is crucial. Our analyses show that acquirers that clearly announce their synergy targets and provide timely follow-up information reap higher shareholder returns.

6. Don’t be seduced by megadeals

The allure of megadeals is undeniable, promising a legacy-defining transaction for executives. Unfortunately, these large-scale deals more often erode value than enhance it. Engaging in major transformative M&A is an extremely risky strategy, given the intricacies of due diligence, execution, and post-merger integration. Such deals can also distract management, causing them to overlook other critical areas of the business.

Our research consistently shows that serial acquirers of small to midsize targets generate the highest long-term value creation. Although these smaller acquisitions demand recurring effort, they are simpler to evaluate, manage, and assimilate. Regularly engaging in such deals strengthens the organization’s M&A capabilities, fostering experienced and well-coordinated teams, streamlined processes, and tested playbooks.

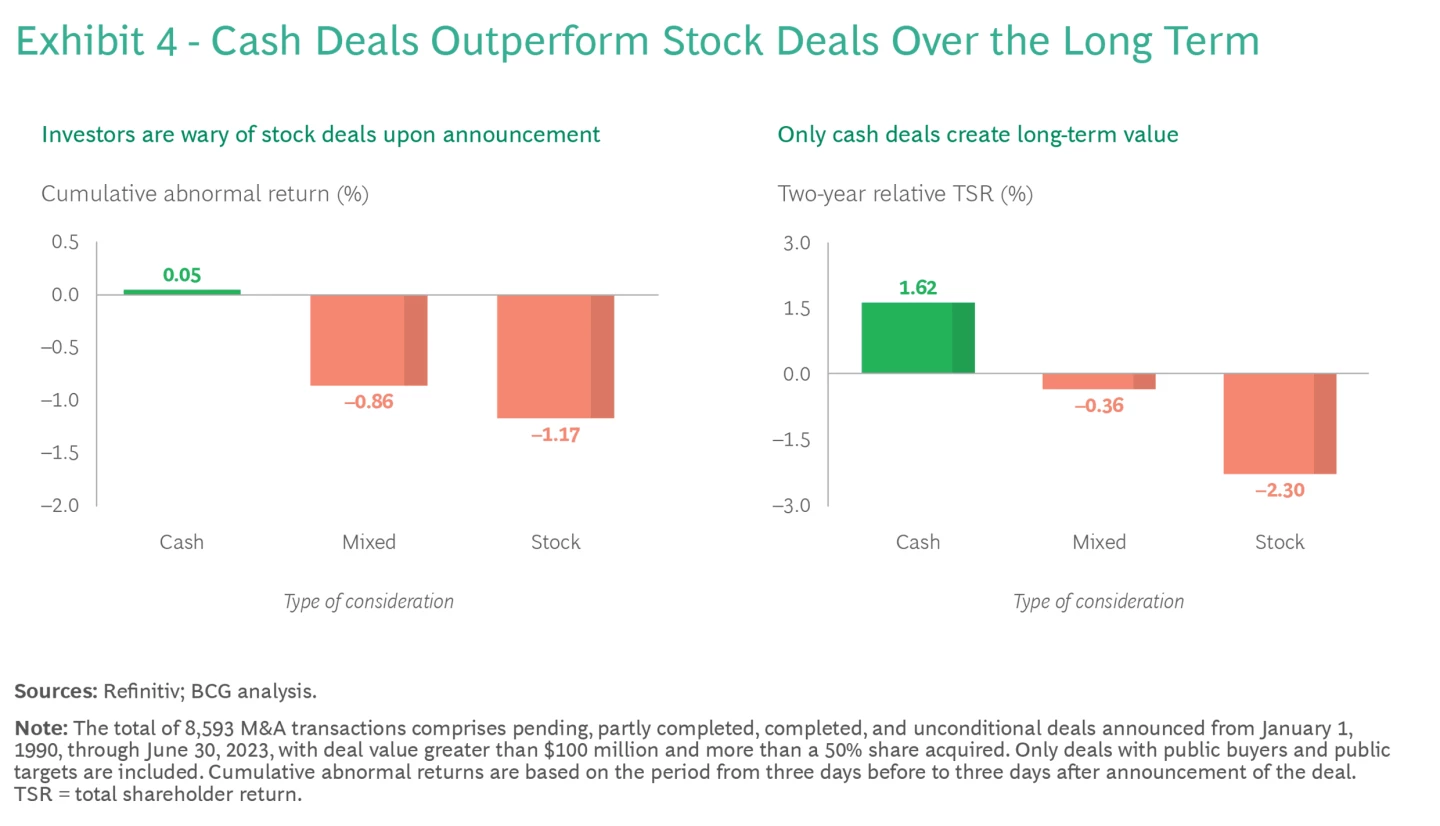

7. Pay more, but only with cash

Common wisdom suggests that overpaying is never profitable, but our research finds that this is not entirely accurate. Although the greatest value creation typically arises from deals with below-average multiples, maximum benefits emerge when low multiples are paired with high premiums over current market valuations. Perhaps counterintuitively, this insight suggests that deal makers should seek opportunities where they can afford a substantial premium over an asset’s current market value due to the asset’s low valuation and the potential for significant synergies. In simpler terms: look for bargains, especially in today’s fluctuating market environment.

8. Think outside the box

Traditionally, the default tool for deal makers has been the plain-vanilla 100% acquisition, on both the buying side and the selling side. For instance, over the past two decades, majority deals outnumbered minority ones by about 3 to 1, although the annual ratio has evolved from 4 to 1 two decades ago to 2 to 1 more recently, largely owing to the rise in VC financing. The attraction of majority deals is clear: they are relatively simple to value and negotiate, and they are amenable to straightforward governance after closing. But in today’s ever-more-complex M&A and business landscape, this approach is not always optimal.

We have observed a consistent rise in alternative deal types, such as minority shareholdings, joint ventures, strategic partnerships, and corporate venturing. These structures may be more complex to execute and manage after closing, but they open new strategic options by allowing deal makers much-needed flexibility to customize capital allocation in response to specific conditions. Given the shift from the past decade’s abundant capital to the current scarcity, these alternative approaches have become an indispensable part of an experienced deal maker’s toolbox.

9. Embrace transparency

Within the typically guarded world of M&A, some executives may not view open communication as a top priority. However, our research suggests that strategic communication at specific stages of the M&A process can bolster value creation. First, investors should not be surprised by potential acquisitions. Putting them on notice requires having an M&A strategy that is clear and well-communicated without limiting management’s strategic flexibility. Second, once a deal is signed, communicating credible and sufficiently detailed plans for synergy and integration (including material ESG efforts) gives investors a baseline for measuring deal success and instills confidence in management’s ability to deliver. Third, internal communication is equally vital. Effective dialogue within the organization facilitates the integration of new acquisitions by setting a unified vision and purpose from the outset. Overlooking internal communication creates the risk of losing top talent during integration or carve-out efforts.

10. Double down on integration design and the post merger integration execution

The importance of execution to successful deal outcomes cannot be overstated. One of our most extensive studies on deal success factors reveals that 30% to 40% of deals fail as a result of, among other factors, poor planning or a lack of strategic fit. In almost half of the failed deals, inadequate or misguided post-merger integration was either among the root causes or the primary cause of the disappointing value creation.

It is essential to remember that closing a deal is only the beginning of the journey, not its culmination. The true challenge of value creation lies ahead, and missteps can negate the hard work and thoughtful preparation that preceded the closing. Following BCG’s 12 imperatives for integration success, based on over two decades of hands-on experience, can help companies avoid pitfalls.

Conclusion

Mergers and acquisitions is one of the most complex and risky endeavors a management team can undertake, and larger deals only raise the stakes. The pitfalls are numerous, ranging from overlooking a critical risk during due diligence to underestimating the challenges of post-merger integration. And, of course, ever-present economic and market uncertainties loom large over any significant investment. By adhering to our ten lessons, deal makers can increase their likelihood of success—especially if they pair these imperatives with a competent team, commitment, hard work, and a willingness to take risks. Simply put, fortune favors those who are not only bold, but also well-prepared.

Source: Website BCG. Some parts have been changed slightly for readability reasons. For the original article click here.