Understanding carve-outs?

An equity carve-out describes the process by which a company separates a division or subsidiary as a standalone company for financial or strategic reasons. The company that results from the carve out has its own board of directors, financial statements, and corporate strategy, however, as the parent company still usually holds a majority stake in the newly created entity.

Carve-outs tend to be common among large FMCG and technology conglomerates that move into and out of segments of their industry as their corporate strategy evolves.

How do a carve-out creates value?

If the logic behind any good acquisition is that the two companies together should create more value than the sum of the parts, the logic of a carve out may be the opposite: Separately, both companies may be worth more.

The reasons for this differ, but usually involve strategic focus to some degree: Even companies in the same industry can have strategies that, by their nature, drag the two in different directions.

For example, a premium retailer and a heavy discounter both sell many of the same items, but their business models are almost contradictory to each other.

The independence that the carve out gives both entities creates value in the following ways:

- Strategic alliances: As part of its independence, the carved out entity may find it easier to create strategic partnerships. For example, with those companies that may have considered the parent company to be a direct competitor and were thus unwilling to cooperate before the carve out.

- Separate funding: The carved out company may find it easier to arrange funding on its own. With a debt-free balance sheet and a different cost of capital to that of its parent, the new entity can seek out financing independent to the parent company and may find it significantly easier given the favourable funding environment for smaller companies.

- Improved access to suppliers and customers: Similarly to the strategic alliances mentioned above, the independence that the carved out entity gains may give it increased access to new suppliers and customers that may have been blocked off before because of various commercial conflicts of interest.

How to measure the created value?

One of the ways to measure the value generated by the carve-out is through an industry sale or an IPO of the carved out entity.

As an example, a large oil and gas conglomerate recently found that its own stock price would likely rise (through the cash proceeds generated by the IPO) and its carved out chemicals division would yield a higher multiple (as multiples for chemicals firms are currently higher than those for oil and gas firms), creating significant value for shareholders in the process.

Difference between a carve-out and spin-off

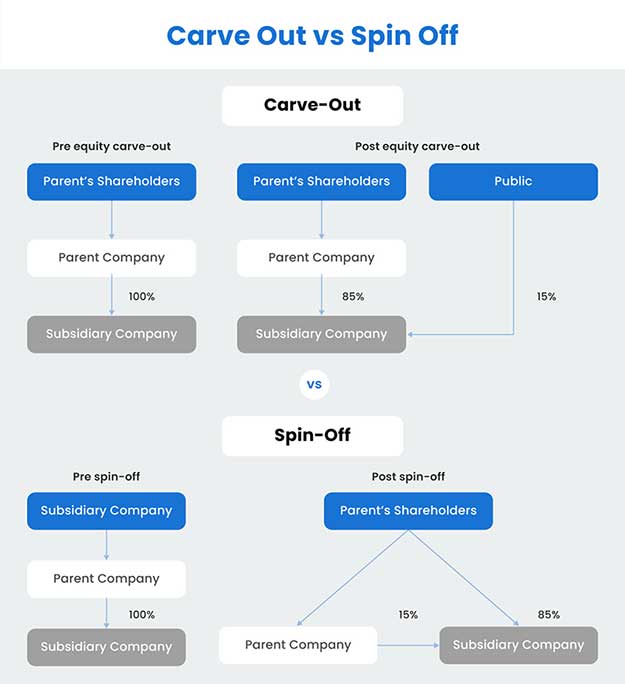

Carve outs are similar to, and sometimes confused with spin-offs. The difference, however, remains very straightforward:

Whereas a carve out involves the parent company, whilst creating a new entity and – this is important – divesting some of its ownership, a spin-off, on the other hand, distributes shares of the new subsidiary to existing shareholders on a pro rata basis (i.e. in the same ratio as the shares they already own in the parent company).

- As with a carve out, the new entity has a separate board of directors, financial statements, and corporate strategy.

- Unlike a carve out, in case of spin off, the shareholder composition remains the same.

Why to consider carve-out in M&A

If your company has a division or subsidiary that could benefit from more strategic focus, then carve out might be the answer.

This happens in many businesses across just about every sector. Firms enter new segments believing that they’ll add value, and at the beginning they often do.

But even companies in the same industry face subtle differences – market and competitive dynamics, suppliers, customers, direct inputs, and more.

A carve out may be the solution in such a case.

Whisper it, but there’s another common reason for a carve out that is less commonly mentioned: Carve outs often happen when divisions or subsidiaries are underperforming, or when the parent company needs the cash from an eventual divestiture.

CEOs are far less inclined to cite either reason for their carve out, but a common reality of such transactions is that they indicate underperformance in one or both of the parent company and the subsidiary.

How to approach carve-outs

As with any transaction, a good place to start is to be prepared. Of all the different forms of M&A transaction, carve outs are among the most complex. The more integrated the two companies are, the more complex the carve out is likely to be.

By using a virtual data room, managers undertaking carve outs can divide the carve out into their different steps, ensuring that each phase of the transaction is well organized and that none of the important details are being missed.

This process can take between 8 and 24 months.

When approaching carve out, here is a recommended plan with detailed considerations:

- Establish a motive for the carve out: Why are you looking to carve out the new entity and whether a carve out is the best answer to resolve your strategic issues.

- Define what needs to be carved out: Is it the whole division or just a subdivision? Assess the cost of spinning off the entity versus the cost of making some organizational changes.

- Establish how the carve out will affect the parent company over a longer period. Does this move impede the parent company in any way?

- Create a strong project management team to implement the change and give them the tools to achieve their goals.

- Using the virtual deal room, create a list of tasks that need to be addressed, who is responsible, and the timeframe for each.

- Begin implementation, focusing on the critical path (i.e. those issues that are crucial to get right rather than the several hundred small issues that could appear).

Carve-out due diligence

The carve-out process related to the due diligence can be broken into two parts.

- Organizational restructuring, where the parent company ensures that the division or subsidiary can be separated without destroying value,

- Then a typical sell-side M&A due diligence, where the newly separated entity looks for an investor to take over management of the company.

Find out how to efficiently do your sell-side due diligence and utilize the sell-side due diligence checklist.

Maximizing carve-out deal value

As always, the best ways to maximize value is to have strong strategic motives, to plan well (including being well-organized), and to implement well. Typically, the companies that generate most value from carve-outs are those that adopt a few behaviours or practices:

- Put a project management team in place. This is the golden rule for carve outs. Without a strong project management team and a set of tools for them to work with, the carve out is unlikely to generate value, regardless of how compelling the motives are for it.

- Set goals for both companies. Both companies cannot lose any of their strategy focus during the carve out. Set short-term goals to be achieved within each of the first three years after the transaction to ensure that attention doesn’t shift from both being successful.

- Create a checklist of the areas in which the carved out entity needs new resources. If the carved out entity has been using the factory floor of the parent company until now, it’s going to need one of its own. There’s a good chance that this goes for most of the support functions as well.

- Create an interdepartmental team to implement the carve out. The links between the two companies probably extend from finance to IT and HR. Create teams that have insight into where the two companies overlap and ensure that they’re contributing to how the carve-out happens with minimum disruption.

- Communicate internally and externally. Work with your staff to see what benefits could come from the carve out and how they see the two entities shaping up. The same goes for select external stakeholders, who may be able to provide some insights that hadn’t seemed obvious before.

When is an equity carve-out not a good idea?

A carve out is not likely to generate value where there remain significant strategic or operational synergies between the parent company and the subsidiary.

These synergies will all largely be lost after the carve-out, with legal restrictions meaning that transactions that previously took place within the entity (for example, raw materials purchased in bulk by the parent company) now have to take place at fair market value.

Any carve out strategy should thus attempt to quantify these synergies before undertaking the transaction.

Conclusion

Understanding carve-outs mean that carve-outs are where the lines between M&A and corporate restructuring begin to blur. That means that they can generate significant value when implemented well, but that doing so involves having capabilities from both. This also means that they tend to be quite a bit more complex.

Undertaking one of these transactions without a good set of project management tools would be burdening your company and its team with a large and unnecessary handicap.

Source: Dealroom. The sales related txt and links were removed for readability purposes.